Who Is Responsible for High Markups in Medical Device Prices? Unraveling the Complex Web

The world of medical devices is a paradox: a sector brimming with life-saving innovations, yet often shrouded in controversy due to its exorbitant pricing. Healthcare providers, patients, and even policymakers frequently grapple with the question: Who is responsible for high markups in medical device prices? Understanding the intricate layers of responsibility, from development to delivery, is not just an academic exercise; it’s a critical step for businesses looking to optimize their purchasing, for investors seeking lucrative opportunities, and for patients striving for affordable care. This comprehensive guide will dissect the various stakeholders, delve into the multifaceted cost drivers, and illuminate strategies to navigate this high-stakes market. By the end, you’ll have a clear picture of where the buck stops and how to take control of your medical device expenditures.

The Anatomy of High Medical Device Costs: A Deep Dive

The perception that medical device prices are simply “too high” is widespread, but the underlying reasons are far from simple. A confluence of factors contributes to the elevated costs we see in the market today.

Research and Development: The Foundation of Innovation (and Expense)

The journey of a medical device from concept to clinic is long, arduous, and incredibly expensive. This initial investment by manufacturers forms the bedrock of subsequent markups.

- Pioneering Breakthroughs: Developing cutting-edge medical technologies isn’t cheap. It involves years of intensive research by scientists, engineers, and medical professionals. Think of the advanced imaging systems, robotic surgical tools, or sophisticated implantable devices; each represents a monumental investment in intellectual capital and raw materials.

- Rigorous Clinical Trials: Before any device can reach a patient, it must undergo stringent clinical trials to prove its safety and efficacy. These trials are often multi-phase, involve large patient cohorts, and can last for years, incurring significant costs in terms of personnel, facilities, and data analysis.

- Regulatory Hurdles and Approvals: Navigating the labyrinthine regulatory landscapes of agencies like the FDA in the United States, the CE mark in Europe, or similar bodies worldwide is a monumental task. Each approval process demands meticulous documentation, adherence to strict quality standards, and often, additional testing, all of which add to the manufacturer’s overhead.

- Patent Protection and Intellectual Property: Once a device is approved, manufacturers typically secure patents to protect their innovations. While essential for recouping R&D investments and incentivizing future innovation, these exclusive rights also grant manufacturers the power to set premium prices without immediate competition. This period of market exclusivity allows them to maximize their profit margins.

Callout Box: The “Valley of Death” in MedTech Many promising medical device innovations falter in the “valley of death”—the challenging phase between initial research and commercial viability—primarily due to the immense financial resources required for clinical trials and regulatory approvals. This high barrier to entry contributes to fewer competitors and, consequently, higher prices for successful products.

The Complex Supply Chain: Where Every Hand Adds a Markup

The journey of a medical device from the manufacturing plant to the patient is rarely direct. It often involves a chain of intermediaries, each adding their own layer of cost.

- Manufacturers: As discussed, they set the initial price, factoring in their production, R&D, and desired profit margins. This can range from a 30-50% markup over their direct production costs.

- Distributors and Wholesalers: These middlemen purchase devices in bulk from manufacturers and then sell them to hospitals, clinics, or other healthcare facilities. They handle logistics, warehousing, inventory management, and often provide sales and technical support. Their services come at a price, typically adding a 20-40% markup.

- Group Purchasing Organizations (GPOs): GPOs act as intermediaries for healthcare providers, negotiating bulk discounts with manufacturers and distributors on behalf of their member hospitals and clinics. While GPOs aim to reduce costs for hospitals, they also extract administrative fees, which can subtly factor into the overall pricing structure.

- Hospitals and Healthcare Providers: This is often where the most significant markups occur. Hospitals frequently apply substantial markups to medical devices when billing patients or insurance companies. These markups are intended to cover not just the direct cost of the device, but also a myriad of operational expenses.

Key Players in the Medical Device Pricing Arena

Pinpointing who is responsible for high markups in medical device prices requires a closer look at each primary stakeholder and their role in the pricing ecosystem.

Manufacturers: The Innovation Engine and Price Setter

Manufacturers are the originators of the devices and, thus, the initial price setters. Their pricing strategies are influenced by:

- Cost of Goods Sold (COGS): This includes raw materials, labor, and manufacturing overhead.

- Research and Development (R&D) Expenses: The amortization of past and ongoing R&D investments is crucial for future innovation.

- Marketing and Sales: Extensive marketing efforts, sales force compensation, and physician education programs add to the price.

- Profit Margins: Like any business, medical device manufacturers aim for healthy profit margins to satisfy shareholders and reinvest in the company. The more specialized or innovative the device, the higher the potential profit margin.

Distributors: The Crucial Link with Hidden Costs

Distributors play a vital role in getting devices to where they’re needed. They manage logistics, inventory, and often provide immediate access to products. However, their services come at a cost.

- Logistical Fees: Transportation, warehousing, and inventory management.

- Sales and Support: Employing sales representatives, providing customer service, and technical support.

- Risk Management: Bearing the risk of holding inventory and potential obsolescence.

Hospitals and Healthcare Facilities: The Final Frontier of Markup

Hospitals and clinics are the ultimate point of sale for most medical devices to patients. Their markups are often the most visible and impactful to the end consumer. These markups are not simply about profit; they are designed to cover a broad spectrum of institutional costs:

- Operational Overheads: This includes the massive costs associated with running a healthcare facility: utilities, rent/mortgage, administrative staff salaries, cleaning, and security.

- Specialized Staff Training: Operating and maintaining complex medical devices often requires highly skilled and specially trained personnel, whose salaries and ongoing education are significant expenses.

- Maintenance and Sterilization: Medical devices, especially reusable surgical instruments, require meticulous maintenance, calibration, and sterilization processes to ensure patient safety and device longevity. These are labor-intensive and costly procedures.

- Insurance and Liability: Hospitals face substantial insurance premiums and potential liability costs associated with medical procedures and device usage.

- Uncompensated Care: Many hospitals provide care to uninsured or underinsured patients, and the costs of this uncompensated care are often absorbed by higher prices for insured patients and procedures.

- Negotiating Power: Larger hospital systems and GPOs have more negotiating power with manufacturers and distributors, often securing lower acquisition costs. However, these savings aren’t always fully passed on to patients.

Case Study: The Pacemaker Paradox Consider a pacemaker. Its manufacturing cost might be a few thousand dollars. By the time it reaches the patient, after distributor markups, hospital operational costs, and the need to cover uncompensated care, the bill could easily be tens of thousands of dollars. The patient sees the final price, which can feel disproportionate to the perceived “cost” of the device itself. ✅ Also check: pacemaker-cost/

The Impact on Patients and the Healthcare System

The high markups in medical device prices have far-reaching consequences that extend beyond individual financial burdens.

Financial Strain on Patients

- High Out-of-Pocket Expenses: Even with insurance, patients can face substantial co-pays and deductibles for procedures involving expensive medical devices. This can lead to medical debt, financial hardship, and even avoidance of necessary care.

- Limited Access to Care: For those without adequate insurance or financial resources, the high cost of devices can be a significant barrier to accessing life-saving treatments or quality-of-life-improving procedures.

- Reduced Trust in the System: The perception of inflated prices can erode public trust in healthcare providers and the medical industry as a whole, leading to cynicism and frustration.

Pressures on Healthcare Providers and Systems

- Budget Constraints: Hospitals and clinics operate on tight budgets. High device costs can force them to make difficult choices, potentially limiting their ability to invest in other critical areas like staff training, facility upgrades, or community outreach programs.

- Negotiation Challenges: Smaller healthcare providers often lack the leverage of larger hospital systems or GPOs, making it harder for them to negotiate favorable pricing, further increasing their operational costs.

- Impact on Innovation Adoption: The high initial cost of new, innovative devices can delay their widespread adoption, even if they offer superior patient outcomes. This can slow down the overall progress of medical care.

Callout Box: The Ethical Dilemma of Pricing The debate around medical device pricing often touches on ethical considerations. Is it ethical to profit significantly from products that are essential for human health and survival? Balancing innovation, accessibility, and profitability remains a core challenge for the industry.

Misconceptions About Medical Device Pricing

Many common assumptions about medical device pricing don’t fully capture the nuances of this complex industry.

- “Manufacturers are the only ones making big profits.” While manufacturers do have significant profit margins, as detailed, the entire supply chain contributes to the final cost. Hospitals, in particular, often have substantial markups to cover their extensive operational expenses and the cost of providing care.

- “Innovation should drive prices down, not up.” In some industries, increased innovation leads to economies of scale and lower prices. In medical devices, breakthrough innovation often justifies premium pricing initially due to the high R&D investment and patent protection. However, as patents expire and competition increases, prices for established technologies can indeed decrease.

- “All markups are pure profit.” While profit is a component, a significant portion of the markup, especially at the hospital level, goes towards covering fixed and variable operational costs, infrastructure, and uncompensated care.

- “Direct sales eliminate all markups.” While buying directly from manufacturers can eliminate distributor markups, it doesn’t remove the manufacturer’s own profit margins or the hospital’s subsequent charges for using the device and providing associated services.

Strategies to Navigate and Potentially Profit from Medical Device Pricing

Understanding who is responsible for high markups in medical device prices empowers stakeholders to make more informed decisions. For healthcare providers, investors, and even policymakers, strategic approaches can lead to better value and efficiency.

For Healthcare Providers and Clinics: Smart Sourcing and Negotiation

- Buy Directly from Manufacturers: Whenever feasible, cutting out distributors can lead to significant cost savings. Many manufacturers are increasingly offering direct purchasing options, especially for larger volume buyers. This allows you to bypass the distributor’s markup entirely.

- Leverage Bulk Purchasing: Consolidating your purchasing power by buying medical devices in larger quantities almost always results in better per-unit pricing. Manufacturers and distributors are often willing to offer discounts for bulk orders.

- Join a Group Purchasing Organization (GPO): While GPOs have their own administrative fees, they can provide access to pre-negotiated contracts with favorable pricing that individual facilities might not be able to secure on their own. Critically evaluate GPO offerings to ensure the savings outweigh the fees.

- Negotiate Aggressively: Don’t accept the first price. Understand your usage patterns, research market benchmarks, and be prepared to negotiate with manufacturers and distributors. Long-term contracts or commitments can also unlock better pricing.

- Explore Refurbished or Used Equipment: For certain non-implantable or non-disposable devices, purchasing refurbished or pre-owned equipment from reputable suppliers can offer substantial savings without compromising quality or safety.

- Stay Informed on Regulatory Changes: New regulations can impact the cost of compliance for manufacturers, which might be passed on to buyers. Staying ahead of these changes can help anticipate price fluctuations and inform purchasing strategies.

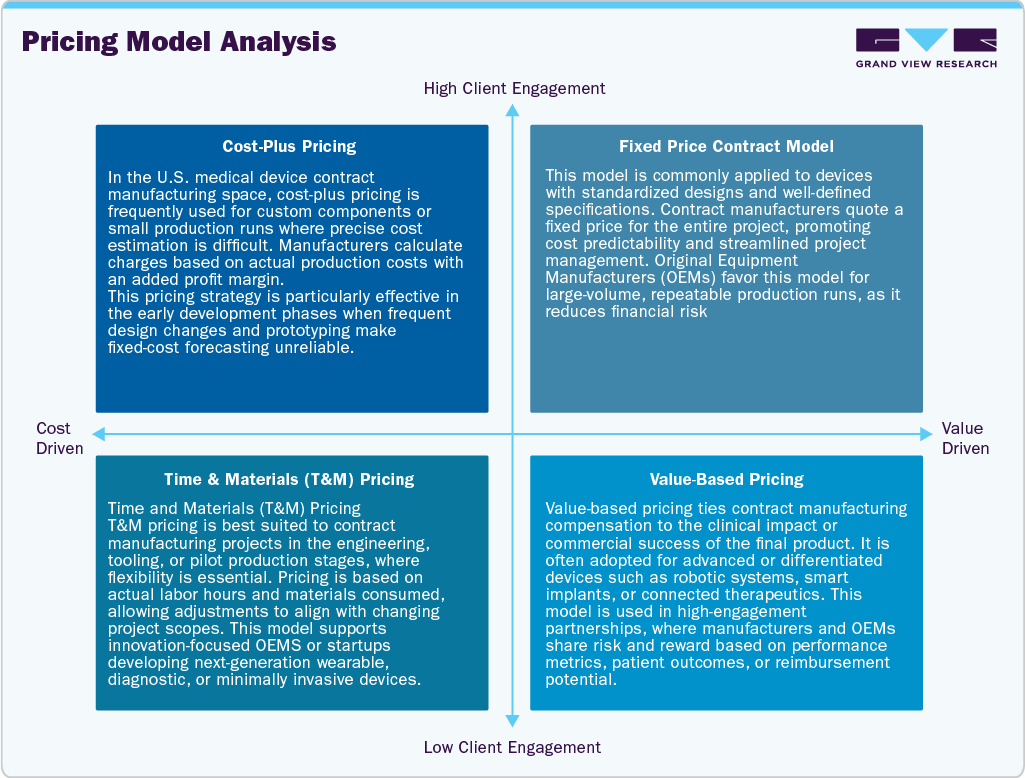

- Value-Based Purchasing: Shift focus from simply the lowest purchase price to the total cost of ownership and the value the device brings in terms of patient outcomes, efficiency, and reduced complications.

- Consider “Pay-Per-Use” Models: Some manufacturers are exploring models where hospitals pay for the device based on its usage rather than a large upfront capital expenditure. This can reduce financial risk and align costs with patient volume. ✅ Also check: pay-per-treatment-pricing-models/

For Investors: Identifying Opportunities in the MedTech Space

- Focus on Innovation with Market Need: Invest in companies developing truly innovative medical devices that address significant unmet medical needs. These often command premium pricing initially, leading to high returns.

- Analyze Supply Chain Efficiency: Companies with optimized supply chains, direct-to-customer models, or strong GPO relationships may have a competitive advantage in managing costs and maximizing profitability.

- Monitor Regulatory Landscape: Companies adept at navigating regulatory pathways quickly and efficiently can bring products to market faster, securing early market share and higher initial profits.

- Evaluate Patent Portfolios: Strong patent protection is a key indicator of a company’s ability to maintain high margins and fend off competition for a period.

- Look for Disruptors: Keep an eye on companies introducing lower-cost alternatives, new manufacturing processes, or novel business models that could disrupt traditional pricing structures.

Outbound Link: For a deeper dive into the economics of medical devices and investment opportunities, exploring industry analysis reports from reputable financial news sources can be highly beneficial. For instance, understanding the broader market dynamics can be gleaned from financial news outlets that cover healthcare investment trends.

The Role of Transparency and Policy in Price Control

Increasing transparency in medical device pricing is a growing demand from patients, advocacy groups, and even some healthcare payers.

- Price Transparency Initiatives: Some regions and countries are implementing policies that require hospitals and manufacturers to disclose medical device prices. The goal is to empower consumers and foster competition.

- Governmental Negotiations: In some national healthcare systems, governments act as single payers and negotiate directly with manufacturers for medical device prices, often leading to lower costs compared to market-driven systems.

- Streamlining Regulatory Processes: While patient safety is paramount, overly burdensome or redundant regulatory processes can add unnecessary costs. Efforts to streamline these processes without compromising safety could potentially reduce R&D and approval costs.

- Promoting Generic/Biosimilar Devices: Similar to generic drugs, the development and adoption of generic or biosimilar medical devices (when feasible and safe) can introduce competition and drive down prices once patents expire.

Case Study: The True Cost of an Advanced Imaging Machine

Let’s consider an advanced MRI machine, a cornerstone of modern diagnostics.

This breakdown illustrates that while the manufacturer sets the initial high price due to innovation and production costs, the subsequent layers of the supply chain, particularly the extensive operational expenses and revenue requirements of hospitals, contribute enormously to the final cost to the patient and the overall healthcare system.

Understanding Related Keywords and Concepts

To fully grasp who is responsible for high markups in medical device prices, it’s helpful to understand related concepts and terminology often used in the industry.

- Value-Based Care: A healthcare delivery model where providers are paid based on patient health outcomes rather than the volume of services. This model can incentivize hospitals to choose devices that offer the best long-term value, potentially influencing manufacturer pricing.

- Cost-Effectiveness Analysis: A systematic process to compare the costs and health outcomes of different medical interventions or devices. This helps decision-makers choose options that provide the most health benefit for the money.

- Supply Chain Optimization: Efforts to streamline the flow of medical devices from manufacturer to patient, reducing waste, improving efficiency, and potentially lowering costs.

- Bundled Payments: A single payment made to healthcare providers for all services involved in a specific episode of care (e.g., a hip replacement, including the device, surgery, and rehabilitation). This encourages providers to manage costs more efficiently across the entire care continuum.

- Medical Technology Assessment (MTA): A comprehensive evaluation of the medical, social, ethical, and economic implications of health technologies. MTAs help inform policy decisions regarding technology adoption and reimbursement.

Frequently Asked Questions (FAQs) on Medical Device Pricing

Understanding who is responsible for high markups in medical device prices often leads to further questions. Here are some common ones:

Q1: Why are medical devices often more expensive in the U.S. than in other countries? A1: Several factors contribute to this. The U.S. market generally lacks price controls seen in many other developed nations. Strong patent protections, higher R&D costs passed onto consumers, complex reimbursement systems, and a multi-payer insurance system all play a role. Other countries often have single-payer systems that negotiate device prices centrally, leveraging significant purchasing power.

Q2: Do high markups stifle innovation in the medical device industry? A2: It’s a double-edged sword. High potential profits from innovative devices incentivize significant R&D investment. However, if prices become prohibitively high, they can limit access and slow down the adoption of new technologies, potentially hindering their full impact on patient care.

Q3: How do GPOs make money, and do they truly help reduce costs? A3: GPOs typically earn administrative fees from manufacturers and distributors, often a percentage of the sales volume generated through their contracts. While they can secure lower prices for member hospitals through bulk purchasing, there’s debate about whether these savings are always fully passed on to patients or if GPO fees add another layer of cost. Effective GPOs can indeed reduce acquisition costs for hospitals, allowing them to allocate resources elsewhere.

Q4: Are there any regulations specifically addressing markups in medical device prices? A4: Direct regulations on markups are rare in the U.S. market. Instead, the focus is often on transparency (e.g., hospital price transparency rules) and encouraging competition. However, some healthcare systems globally have more direct control over pricing through negotiations or fixed reimbursement rates.

Q5: What’s the difference between the “sticker price” of a medical device and what hospitals actually pay? A5: The “sticker price” is often a list price set by the manufacturer. Hospitals, especially larger ones, rarely pay this amount. They typically negotiate significant discounts based on volume, long-term contracts, and GPO affiliations, meaning their actual acquisition cost is considerably lower than the list price. The “markup” then applies to this negotiated acquisition cost.

Q6: What is the role of insurance companies in medical device pricing? A6: Insurance companies play a significant role as payers. They negotiate reimbursement rates with hospitals and healthcare providers for procedures, which inherently influences the prices hospitals charge for devices. Insurers try to control costs, but the complex billing and coding systems can make it difficult to ascertain the exact profit margins on individual devices.

Q7: Can patients do anything to reduce the cost of medical devices they need? A7: Patients have limited direct control over device costs but can:

- Ask for Price Estimates: Before a procedure, ask your provider for a detailed estimate that breaks down device costs.

- Shop Around: For elective procedures, compare prices between different hospitals or clinics if feasible.

- Understand Your Insurance: Know your deductible, co-insurance, and out-of-pocket maximums.

- Negotiate Bills: If you receive a surprisingly high bill, don’t hesitate to call the hospital billing department and inquire about negotiation options or financial assistance.

Q8: What impact do lifestyle habits have on the need for certain medical devices? A8: While lifestyle habits don’t directly influence the markup of a specific device, they significantly impact the need for many medical devices. For instance, poor dietary habits, lack of exercise, and smoking can lead to chronic conditions like heart disease, diabetes, or lung disease, which often require extensive medical interventions, including various devices. A healthy lifestyle can reduce the likelihood of needing devices like pacemakers, insulin pumps, or even some orthopedic implants. ✅ Also check: anti-aging-2/anti-aging-diet/

Conclusion: Taking Control in a High-Stakes Market

Understanding who is responsible for high markups in medical device prices reveals a multi-layered system where manufacturers, distributors, and especially hospitals, all contribute to the final cost. While innovation and regulatory compliance demand significant investment, the lack of transparency and intricate supply chains often allow for substantial price escalation.

For healthcare providers and businesses, strategic sourcing, leveraging bulk purchasing, and direct negotiation are powerful tools to control expenditures and boost profitability. For patients, advocating for transparency and understanding your billing rights can mitigate some of the financial burden. The future of medical device pricing will likely involve continued debates around transparency, value-based care, and the balance between fostering innovation and ensuring affordable access to life-saving technologies. By staying informed and adopting strategic approaches, you can navigate this complex landscape more effectively and make smarter financial decisions.

Ready to gain more control over your medical device procurement and unlock better deals?

Visit our shop for exclusive offers and competitive pricing on a wide range of medical devices: https://tiredealsnow.com/shop/